With the recent award of funding to 6 dispatchable capacity projects across Victoria and South Australia on 4 September 2024, the pilot auction process of the Capacity Investment Scheme (CIS) has now come to a close. There were six battery projects selected in total, two in Victoria and four in South Australia. Collectively, they are expected to contribute almost 1GW of dispatchable capacity to the National Electricity Market (NEM) (excludes WA and NT) before the end of 2027.

Origins and development of the CIS

The CIS was first announced in the 2023-24 budget and was further expanded in November 2023 to:

- Deliver an additional 32 GW of new capacity by 2030 (around half of current NEM generation) consisting of 23 GW of renewable capacity and 9 GW of clean dispatchable capacity

- Support delivery of the Commonwealth’s 82% renewable electricity target by 2030

The CIS is effectively a replacement for the Renewable Energy Target (RET) scheme which was initially introduced in 2019 and is set to end by 2030. Under the RET scheme, renewable energy power stations whether grid-scale or small-scale are accredited renewable generation certificates for each MWh of energy generated which can be traded and sold on the secondary market. The design of the scheme favoured renewable generation (i.e. wind and solar) over dispatchable capacity projects. Additionally, since renewable generation certificates could still be sold regardless of the spot price of electricity this disincentivised the market from holding excess supply, missing an opportunity to reduce price volatility and negative pricing.

Government is stepping up to the crease

Sluggish investment, especially in utility scale generation, has justified the need for government intervention. Other than the Uungula wind project that just reached financial close in December 2023, the Clean Energy Council reported that there were no grid-scale wind projects that reached financial commitment in 2023, down from six in the previous year. Additionally in Victoria, only four renewable generation projects were completed in 2023, two solar farms and two wind farms.

Although financial commitment for grid-scale projects have picked up in Q1 of 2024, significant and sustained investment is still required. To meet the Commonwealth’s 82 per cent target, 6GW of utility scale generation would need to come online annually. To put this into perspective, Climate Change and Energy minister Chris Bowen predicts this would require at least 40 wind turbines installed per month.

Additionally, the pace of the energy transition has needed to accelerate to meet the rapid retirement of coal generators that have occurred earlier than originally forecasted by AEMO. Over the last decade, 10 coal fire generators have retired and owners of all but one coal fire power plant have announced retirement by 2051.

Powering up with the CIS

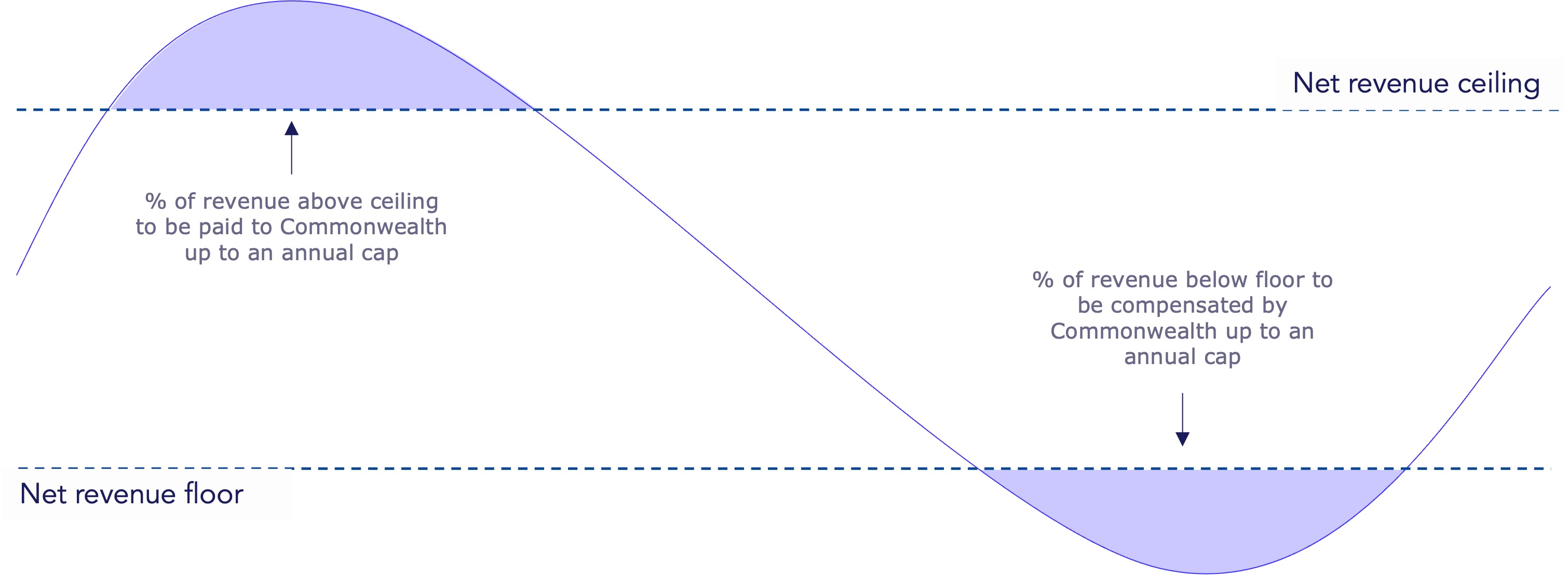

The CIS takes an alternative approach to the RET scheme by providing the minimum net subsidy or financial security required to bring both storage and renewable generation projects online while requiring developers to still maximise the share of their returns through energy and ancillary service markets. The CIS largely follows the Long-Term Energy Service Agreements (LTESAs) as contracts for difference with ‘floor’ and ‘ceiling’ net revenue values.

Figure 1: CIS payoff profile

The 32 GW of additional renewable capacity will be delivered in the following manner:

- 18 GW through Renewable Energy Transformation Agreements (RETAs) as part of the National Energy Transformation Partnership between State, Territory and Commonwealth governments

- 16 GW through a guaranteed national tender.

The goal of the RETAs are to align state and territory schemes with CIS objectives and failure by States or Territories to satisfy its RETA obligations may result in a state’s original allocation being reallocated. The bottom line is that States need to have an independent co-ordinated plan to meet their own renewable targets and cannot simply rely on CIS funding.

The progress being made by the CIS

The pilot stages of the CIS have recently completed with the following awards made:

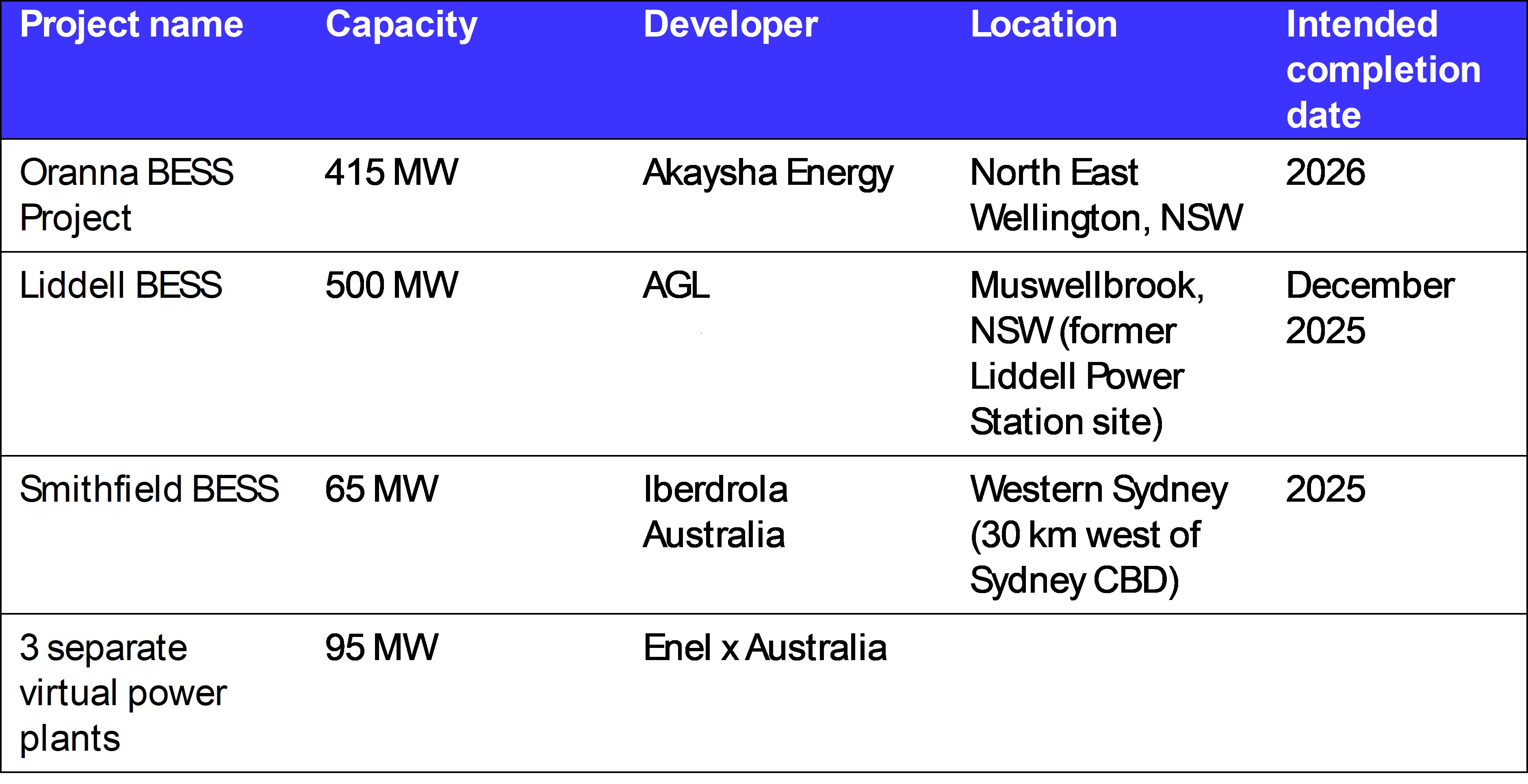

Part 1 – NSW Tender

Source: DCCEEW, Closed CIS tenders

Results for this tender were released on 22 November 2023.

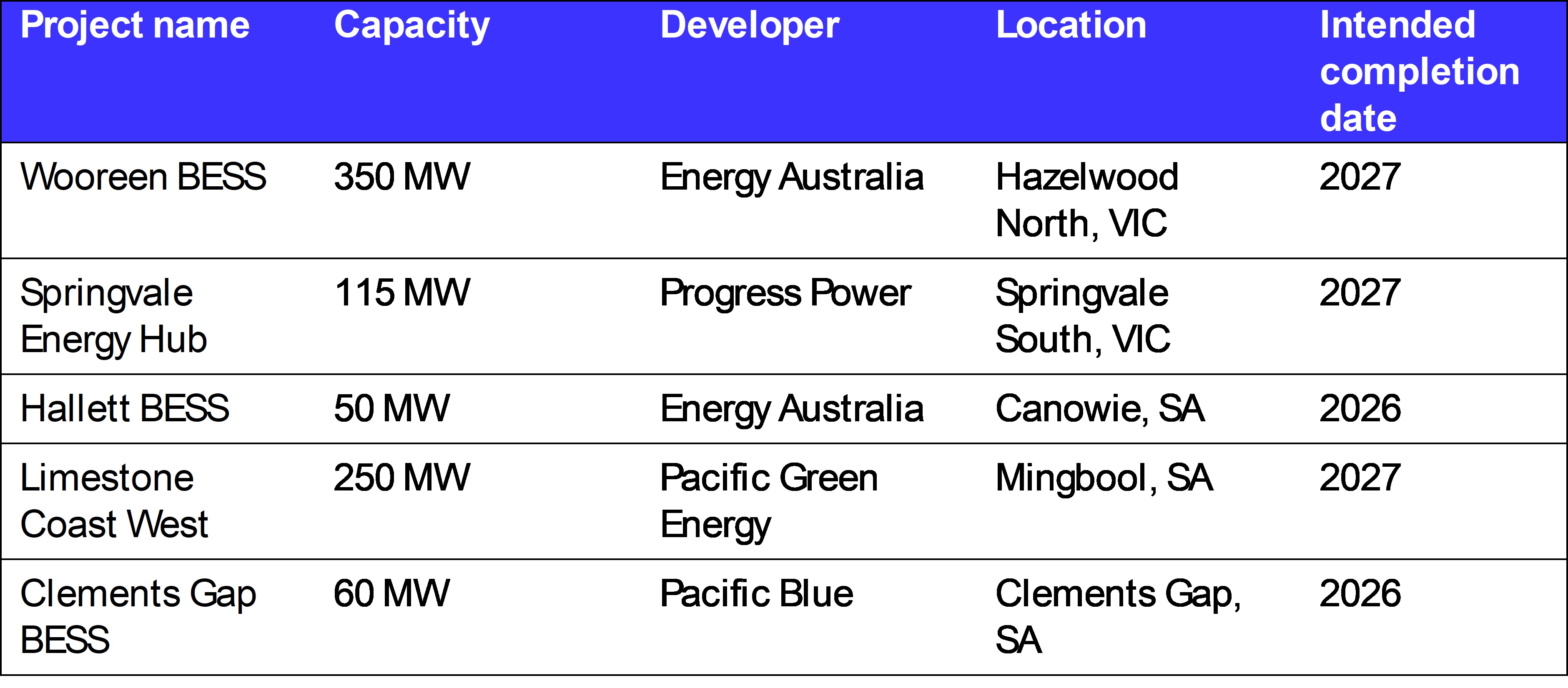

Part 2 – South Australia- Victoria tender

Source: DCCEEW, Closed CIS tenders

The pilot tender was particularly successful with reported bids of 19 GW in total, 32 times its intended target. In fact, South Australia-Victoria tender secured close to 1000 MW of dispatchable capacity significantly exceeding the original target of 600 MW.

Continuing focus on storage

Although dispatchable capacity represents a smaller portion of the CIS, its emphasis in both rounds of the pilot tender suggests an urgency to strengthen this aspect of the grid. Policymakers had initially considered introducing a dedicated capacity scheme to complement the RET scheme but ultimately opted for a combined approach with the CIS Scheme. Fortunately, while renewable generation projects remain sluggish, dispatchable capacity projects have surged in recent years, reaching a record $4.7 B in financial commitments in 2023, up from $1.7 B the year before.

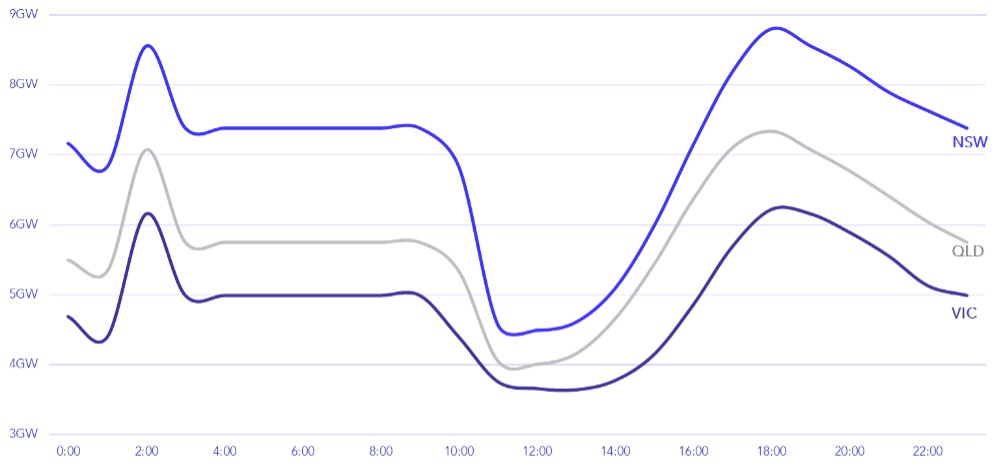

While the expansion of grid-scale dispatchable capacity is encouraging, it must keep pace with the rapid growth of rooftop solar and the gradual rise in grid-scale solar projects. Australia’s position as the global leader in rooftop solar uptake brings the challenge of managing excess energy when demand is low. This mismatch –- high electricity generation when the sun rises followed by surging demand after sunset –- is known as the ‘duck curve’.

Figure 2: Average intra-day energy demand in September 2024

Source: AEMO aggregate price and demand data – current month

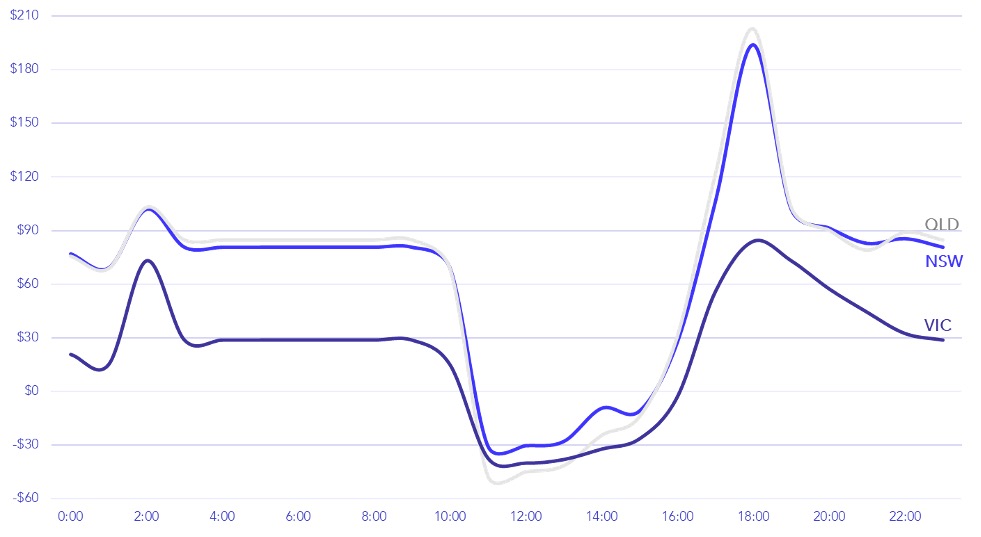

Figure 3: Average intra-day wholesale electricity price in september 2024

Source: AEMO aggregate price and demand data – current month

The mismatch between supply and demand has resulted in frequent negative electricity prices in the afternoon, making the NEM the most volatile energy electricity market globally. Bringing more dispatchable capacity projects online will help smooth out the operational demand curve leading to more stable and predictable prices for consumers.

What remains unclear is whether the CIS scheme will effectively incentivise long-duration energy storage projects, such as pumped hydro, given its focus on near-term operational projects and the lengthier construction and approval timelines for such projects.

What’s next?

The first standalone CIS Tender 1 for renewable capacity generation was launched on 31 May 2024 and is currently in Stage B, the financial value bid portion of the process. The results are expected to be announced by December 2024. CIS Tender 1 is seeking 6GW of renewable capacity with a minimum split across states as follows:

- New South Wales: 2.2 GW

- South Australia: 300 MW

- Victoria: 1.4 GW

- Tasmania: 300 MW

Following the start of CIS Tender 1, further tenders will be run approximately every six months until 2027.